Solana continues to outperform the broader crypto market. While the overall market is up just 0.5% in the past 24 hours, the Solana price has gained nearly 3% at press time — extending its steady uptrend from the past three months.

The token has climbed about 37% in that period, showing consistent strength even through market slowdowns. But the more interesting part isn’t the short-term move. New technical and on-chain metrics now suggest that Solana may be preparing not just for another rally, but a possible breach of its previous all-time high near $293.

A Hidden Signal Suggests SOL’s Uptrend Isn’t Over Yet

On Solana’s daily chart, a hidden bullish divergence has appeared, a setup where the price makes a higher low while the Relative Strength Index (RSI) makes a lower low. Traders use the RSI to measure momentum and identify when a move might continue or slow down.

This pattern often signals that an uptrend is gaining strength rather than reversing. The last time Solana showed this structure — between April 7 and June 22 — the price climbed 63.63% in just a month. A similar divergence formed between August 2 and September 25, and around 24% of that potential move has already played out.

If Solana follows the same trajectory, the price could reach $312 by late October, roughly mirroring the timing and scale of the earlier rally.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

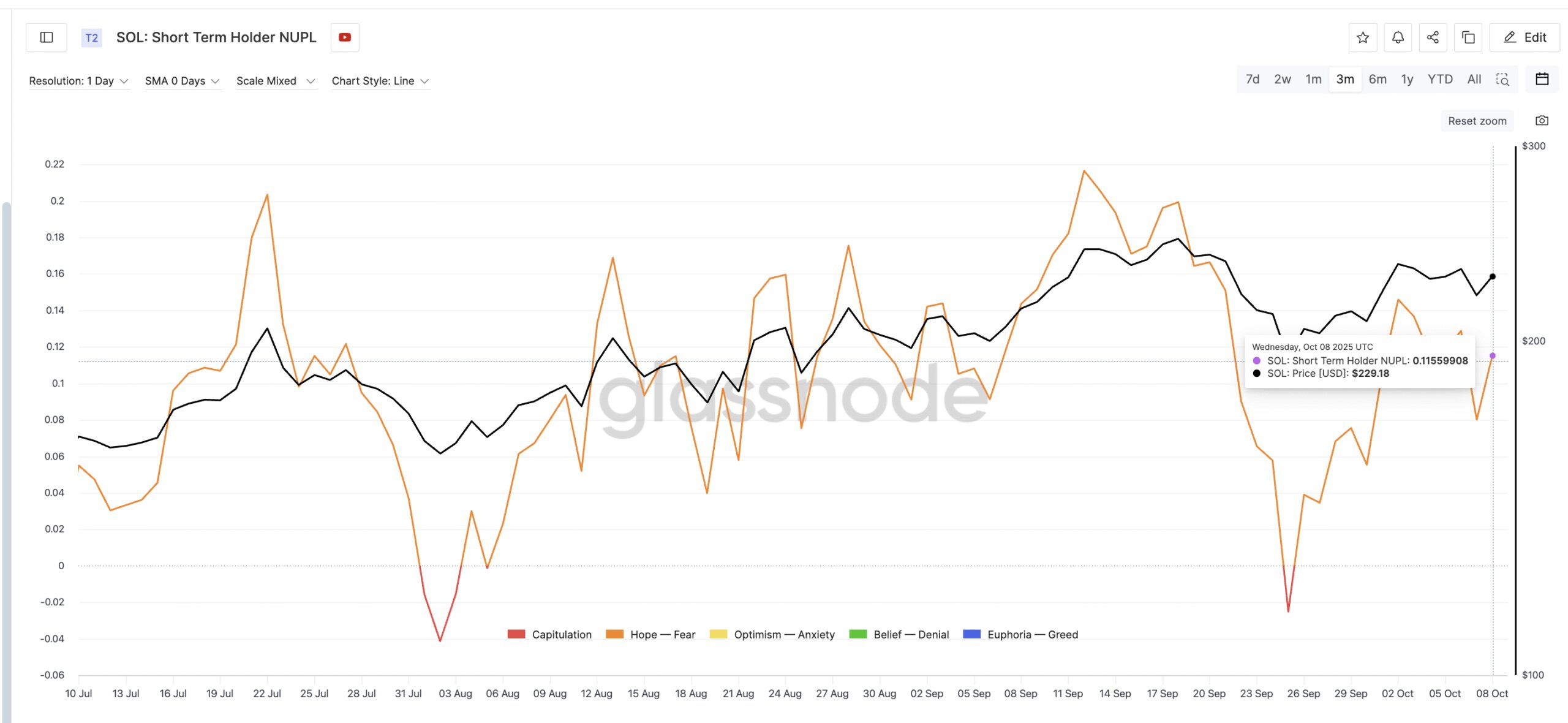

On-chain data adds more confidence to this view. The short-term holder NUPL (Net Unrealized Profit/Loss), which tracks whether recent buyers are sitting on profits or losses, currently stands at 0.11. This level typically signals controlled profit-taking, not overexcitement.

In previous cycles, NUPL values around 0.20–0.21 marked local tops — such as in July and September — when short-term holders began selling aggressively. Today’s level near 0.10–0.11 is closer to the “steady zone” seen in August, when Solana climbed after minor dips.

This suggests there’s no danger of a major top yet, and the market still has room to move higher, validating the divergence-led expectations.

Solana Price Setup Suggests Room To Test Higher Levels

At press time, Solana trades near $226, facing immediate resistance at $251, which aligns with the 0.618 Fibonacci extension — a level often considered a pivot point during sustained uptrends. A clean close above this mark could push SOL toward $288, followed by a retest of the $293 all-time high, a major psychological level for traders.

If the Solana price breaks above that, the earlier fractal projects a move toward $312 and even $349, new potential milestones.

However, if the price falls below $213 and then $190, the bullish continuation thesis weakens, signaling a possible short-term pullback or even a deeper correction.

The post Solana’s Hidden Bullish Signal Returns — Could a New All-Time High Be Imminent? appeared first on BeInCrypto.