XRP has struggled to keep up with the broader market. While other altcoins have rallied strongly, the XRP price has managed just a 3.1% gain over the same period. Despite holding near $3, it has repeatedly failed to break higher.

The reason comes down to two key factors: a bearish chart pattern that continues to limit upside moves, and steady selling by one key trader group, even as large holders quietly accumulate.

Whales Buy as Retail Sells — A Stalemate Slowing XRP’s Breakout

On-chain data shows a growing divide between whales and retail investors.

Wallets holding between 100 million and 1 billion XRP have increased their holdings from 8.95 billion to 9.59 billion XRP since late September — a 7.1% jump, worth about $1.9 billion at the current XRP price. This shows large holders have been steadily buying despite the range-bound price movement, helping prevent any deep price drops.

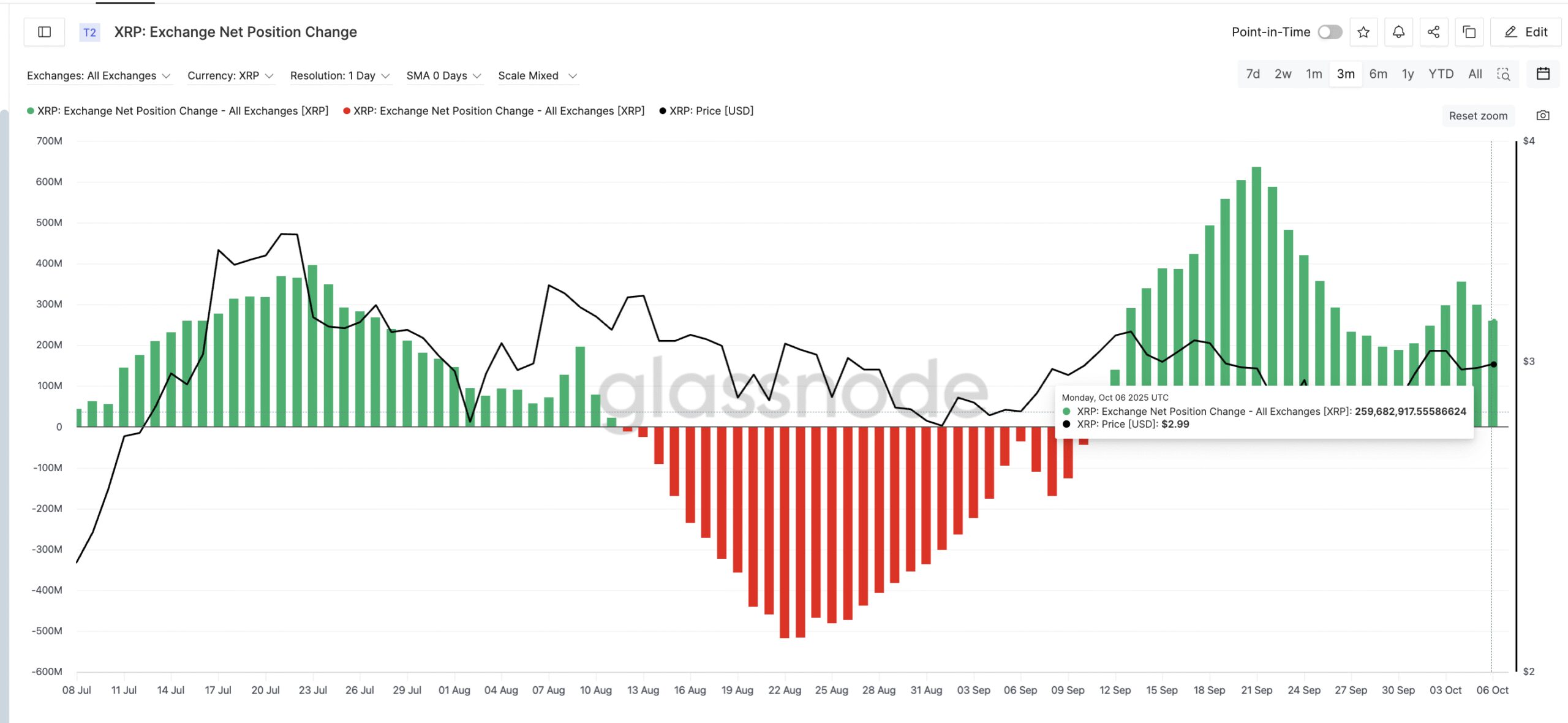

At the same time, exchange net position change — which tracks whether coins are flowing into or out of exchanges — has moved sharply higher, from 197 million XRP on September 29 to 259 million XRP on October 6, a 31% rise. With whales adding close to $2 billion in XRP to their stash, the increased selling pressure seems to be from the retail exits.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

A rising figure means more XRP is being sent to exchanges, often a sign of selling pressure. This indicates that retail traders are still looking to take profits or exit quickly while whales continue to buy.

This opposing behavior has created a kind of stalemate. Whales are doing enough to support XRP’s price, but retail selling is preventing a clear breakout. For XRP to move higher, retail participation needs to flip from selling to holding or accumulating.

XRP Price Still Trapped in a Bearish Channel

On the daily chart, the XRP price remains inside a descending channel, a bearish pattern where lower highs and lower lows continue to form. The upper trend line, acting as resistance, has capped XRP’s moves since October 2.

A daily close above $3.09 — which sits right above this trend line — would confirm an XRP price breakout from the pattern and mark the end of the ongoing bearish structure.

If that happens, XRP could start catching up with other altcoins, targeting $3.33 and $3.58 next.

However, a dip below $2.94 would strengthen the bearish setup and may pull the price back toward $2.88 before any recovery attempt.

For now, XRP’s next big move hinges on one question: can it finally close above $3.09 and join the wider altcoin rally?

The post XRP Price Metrics Reveal Why the Rally May Only Begin Beyond $3.09 appeared first on BeInCrypto.